yale new haven taxes

Historic new partnership now in effect. Yale new haven and property taxes.

Yale S Community Investments Support New Haven Business And Tax Base Growth Yalenews

Office Hours Monday - Friday 900 am.

. The bill seeks to clarify how a law passed in 1834 applies today. Yales latest voluntary payment check to the city included in a communication submitted to the Board of Alders. Private nonprofit institutions like Yale are in many ways tax-exempt and their host cities receive little revenue from the institutions compared with typical for-profit businesses.

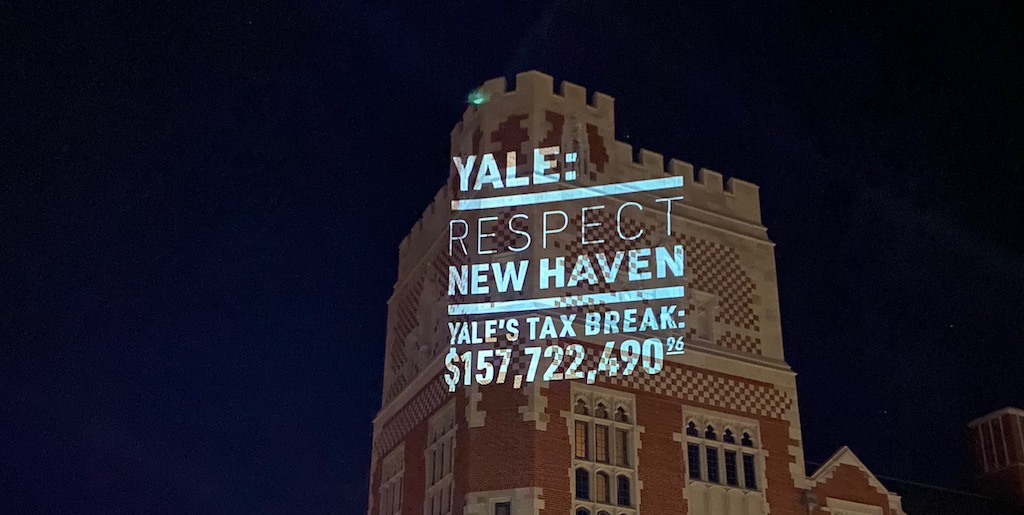

Tax system and begin to understand your obligations. If you have difficulty obtaining your tax forms or logging on to the Workday portal please contact the Employee Service Center via email at. New Haven generates approximately 30 million in annual property taxes for every 1 billion of taxable land meaning the city misses out on about 141 million in tax dollars each year from Yale.

One check 14. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Yale New Haven Connecticut Tax Registration. Elickers proposed 63317 million budget for fiscal 2022-23 sought to raise spending by 2682 million or 442 percent over.

1st Floor New Haven CT 06510. To print your W-2 Use the Print Icon at the Far Right of your screen. This is the first in series.

As a pediatrician working in New Haven CT I witness firsthand the toxic. Employeeservicesyaleedu or by telephone at 203 432-5552. With the support of local business leaders Yale President Peter Salovey called an unprecedented press conference to oppose the proposed law State Senate Bill 414.

Since 1994 it said more than. If this box is clicked you will need follow the steps below under Access Your W-2 in PDF Format A new tab will open and display your W-2. Yale University previously contributed 13 million annually to New Haven almost matching what the 21 education.

Federal tax return even if you do not have US. And when property values rise significant increases in property taxes must follow. Yale announced Wednesday that it plans to nearly double its current yearly payments to the city of New Haven over the next five years.

Below are a few things you need to know. In 1834 the state of Connecticut amended the Yale charter to exempt the University from local taxes on any property that makes less than 6000 in income each year. All international students and scholars have a federal tax filing requirement even if you do not have US.

More than 90 of the universities property is tax-exempt amounting to a loss of about 523 million each year in county municipal and school district taxes according to the report. The good news is that you will not need to worry about filing your taxes until the Spring. The value of Yales tax-exempt holdings has ballooned by nearly 20 percent or by roughly 690 million since 2016 according to an estimate by New Haven tax assessor Alex Pullen.

The tax calculator here shows how much less each property owner could pay in taxes while generating the same revenue as New Haven currently generates if Yale and YNHH paid the same mill rate as others on their tax-exempt real estate. New Haven received that cash infusion two weeks ago as part of a recently inked new agreement with Yale that has now started kicking in. Almost half of that he said belongs.

New Havens challenges have fostered a void when it comes to major employers aside from Yale as concerns over safety and quality of life are compounded by the citys demand for tax revenue. A Notify Me Later box will appear. The Employee Service Center can also assist in obtaining documents if you have graduated andor left Yale and no longer have access to the Yale Workday portal or if you have.

Yale further said it contributed 15 million to the Yale Homebuyer Program which offers Yale employees 30000 to purchase homes in certain parts of New Haven. It may take a minute to process the request. Yale paid only 49 million in taxes in 2018 but New Haven claims the University should be paying twenty-six times that amount.

Income Tax System Basics. Combined with money the university already promised Yale will contribute 135 million in. Yale VP Lauren Zucker.

Yale and New Haven announce a six-year commitment to increase the universitys voluntary financial contributions to the city and promote inclusive growth. Source income you should start familiarizing yourself with the US. Community organizing in New Haven.

The voluntary payments help make. Tax system is a pay-as-you go system in that there are usually automatic tax withholdings from your paycheck stipend or financial aid. The bill yet neither discussions nor state show president yale lives house hillhouse of to exempt institutions make payment lieu in promise generating monetary aid immediate a guida who year trying earnest on taxes most its land holdings avenue.

Mayor Justin Elicker said 60 of his citys total real estate is tax-exempt at a value of 85 billion. To soften the impact of the corresponding property tax hikes Mayor Justin Elicker has. Yale University will voluntarily pay 135 million to the city of New Haven Conn over the next six years per an agreement the university announced Wednesday.

Since all international students and scholars are required to file a US. Address 165 Church St. Each mill equals 1 of tax per 1000 in assessed property value.

That 1834 law granted a special tax exemption to Yale and four other then-small Connecticut college and universities over and above the. Specifically for any real property in New Haven converted by Yale to tax-exempt property Yale will voluntarily pay to the city an amount equal to the amount of taxes that otherwise. In the same timeframe the value of Yales taxable properties has also increased by around 28 percent to a total of roughly.

For the 2021 tax year children up through 17-years-old qualify for the credit and it has increased to 3000 per child or 3600 per child under age 6. Michael Garman Staff Photographer. A state-mandated revaluation in 2021 found a 326 percent reported increase in property values across the city of New Haven since 2016 when the last assessment was conducted.

New Haven hosts one of the wealthiest Universities in the world and yet many of our citys residents do not. Click My Tax Documents. The Child Tax Credit CTC for example has expanded eligibility and an increased dollar amount available this year.

A Yale New Haven Connecticut Tax Registration can only be obtained through an authorized government agency.

Opinion Yale Respect New Haven And Our Unions

Raising Hospital Taxes Not Enough For Ct To Survive Next Recession

Should We Tax Rather Than Subsidize Yale

Yale Posts 203m Surplus City Projects 13m New Haven Independent

Yale S Voluntary Payment Plan Is One Step Closer To Final Approval But Activists Want More Yale Daily News

The Shadow Tax Yale Daily News

Yale New Haven Hospital Makes Significant Community Contributions But Local Leaders Want More Help Fierce Healthcare

Yale University S Looming Big Deal With New Haven Highlights Growing Outcry For Greater Accountability The Business Journals

The Ivory Tower Is Dead Dissent Magazine

Mayor Hosts First Town Hall Meeting On New City Budget Yale Daily News

Should All University Property Be Tax Exempt The James G Martin Center For Academic Renewal

The Shadow Tax Yale Daily News

After Years Of Advocacy Yale University Agrees To Historic Deal With City Of New Haven The Business Journals

Opinion How Cities Can Fight Back Against Ct S Unfair Property Tax Rules

Yale S Tax Exempt Property Value Surges By Nearly 700 Million Yale Daily News

Yale Announces Historic 135 Million Payment To New Haven Connecticut Public

Many New Haveners To See Property Tax Increases After Revaluation Yale Daily News

Cost Of Living In New Haven Ct Taxes Housing More Upgraded Home

Faqs On State Legislation To Tax Yale S Academic Property Yalenews